Banks PAN Number List of Bank Home Loan Providers PAN Numbers

Table of Content

- Where can I find the home loan PAN number?

- Why do you require each bank’s PAN number?

- PAN Numbers for Home Loan of All Banks

- How to link PAN Card to Bank Of India Account offline?

- Highest FD Interest Rates

- Implications of non linking of PAN with your Bank Of India Account

- PAN Number for Banks in India 2022

You can pay over and above the EMI to close the Home Loan early. Lump-sum deposit in home loan or part payments as per the comfort of the borrower can be made. Home Loan borrowers to submit duly filled in prescribed Application Form to the concerned Branch along with other documents as per the scheme guidelines. Under the scheme, the borrower has the option to deposit all his savings in the linked SB account to avail maximum benefit of interest in the Home Loan account. Bank of Baroda focuses on its employees, offering a career rather than just a job.

Renovating your home can be a costly affair, but our home improvement loan can turn your dream home into reality. Bank of Baroda deposit plans offer convenient solutions to both working individuals as well as senior citizens. These deposits are categorised into deposits with a term period of less than 12 months, more than 12 months and recurring deposits.

Where can I find the home loan PAN number?

They provide Prepayment of loan without any charges under the option of floating rate. This loan has a maximum limit of 50 Lakhs with repayment option up to a maximum of 30 years, which can be taken through reasonable marginal and processing charges having no additional charges at all. These articles, the information therein and their other contents are for information purposes only.

What is the maximum loan amount that has to be borrowed under the Bank of India Star Home Loan scheme? Under the Bank of India Star Home Loan scheme, an applicant will be able to avail up to Rs.500 lakh for the construction or purchase of a housing property. The loan amount will be subject to the geographical location of the property. In addition to that, applicants can also avail loans for the renovation, extension, or repairs of an existing housing property. As mentioned in the table above, a minimum credit score of 675 is ideal for availing a home loan from Bank of India.

Why do you require each bank’s PAN number?

The term for the loan will under no circumstances exceed the age of retirement or completion of 65 years of age, whichever is earlier. B3 Silver Account comes with maximum savings and zero Quarterly Average Balance . Also, make the most of coins and annual offers from Loyalty Rewardz to fulfill yearlong subscriptions and shopping. Photocopy of your ID card provided by the present employer, duly attested.

Various initiatives are in place to groom employees throughout their life cycle. A comprehensive talent management system to groom future leaders of the bank. Digi Hub is one of the innovative solutions that Bank of Baroda is pioneering to serve its Radiance customers outside large cities where bank has relatively leaner presence of specialized investment teams. Invitation of applications for empanelment of advocates/ firms on banks panel. In the absence of PAN Card, TDS will be recovered at 20% (as against 10% no matter in which tax slab you fall) in case of bank fixed deposits , if the interest on FD exceeds Rs 10,000 in one financial year.

PAN Numbers for Home Loan of All Banks

The loan providers have made certain adjustments to their house loan payment certificate in order to simplify the income tax process. You are exempt from entering the bank’s PAN number in accordance with the requirements of the new system. No matter how dramatic the implementation and execution of GST in India was, tax exemption on home loans will continue to make people happy. The process of filing income tax return has begun and everyone is busy in collecting documents that can help them save tax. From now onwards, you have to mention the PAN number of the bank to avail tax exemption on home loans. The eligibility criteria for women applicants are in line with the other borrowers.

However, a higher CIBIL score strengthens the possibility of your home loan application being approved. In addition to that, Bank of India offers interest rates based on CIBIL score only for some of the home loan schemes such as the Star Home Loan, the Star Diamond Home Loan, and the Star Smart Home Loan. A number of factors go in to checking the home loan eligibility. The approximate loan amount that you will be eligible for can be determined using the home loan eligibility calculator of Bank of India.

Competitive interest rates and availability of different EMI options suited for different customers enables them to pay their repayment amount with ease. The maximum repayment tenure for Bank of India Home Loans is primarily dependent on the age of the applicant. Getting a home loan earlier will make you eligible for the longest loan repayment term. The following list shows the maximum loan repayment tenure that an applicant will be eligible for on the basis of his or her age. To understand the need for a PAN number of the bank, one needs to understand the Income Tax Act of 1961, and in particular, section 24B. Section 24B states that one can claim tax benefits on the interest paid for a housing loan.

This link is provided on our Bank’s website for customer convenience and Bank of Baroda does not own or control of this website, and is not responsible for its contents. The Website/Microsite is fully owned & Maintained by Insurance tie up partner. This facility is for customers who do not have account with Bank.

A representative of the Bank of India or an online partner can contact you to discuss eligibility for your loan as well as rates, terms, processing costs and other expenses. We have mentioned the list of all the banks like SBI PAN Number, HDFC PAN Number, and several other banks’ PAN numbers. You can read the lists and use the PAN number for your tax exemption while filing the Income Tax Returns. Urban Money is India’s one of the unbiased loan advisor for best deals in loans and unmatched advisory services.

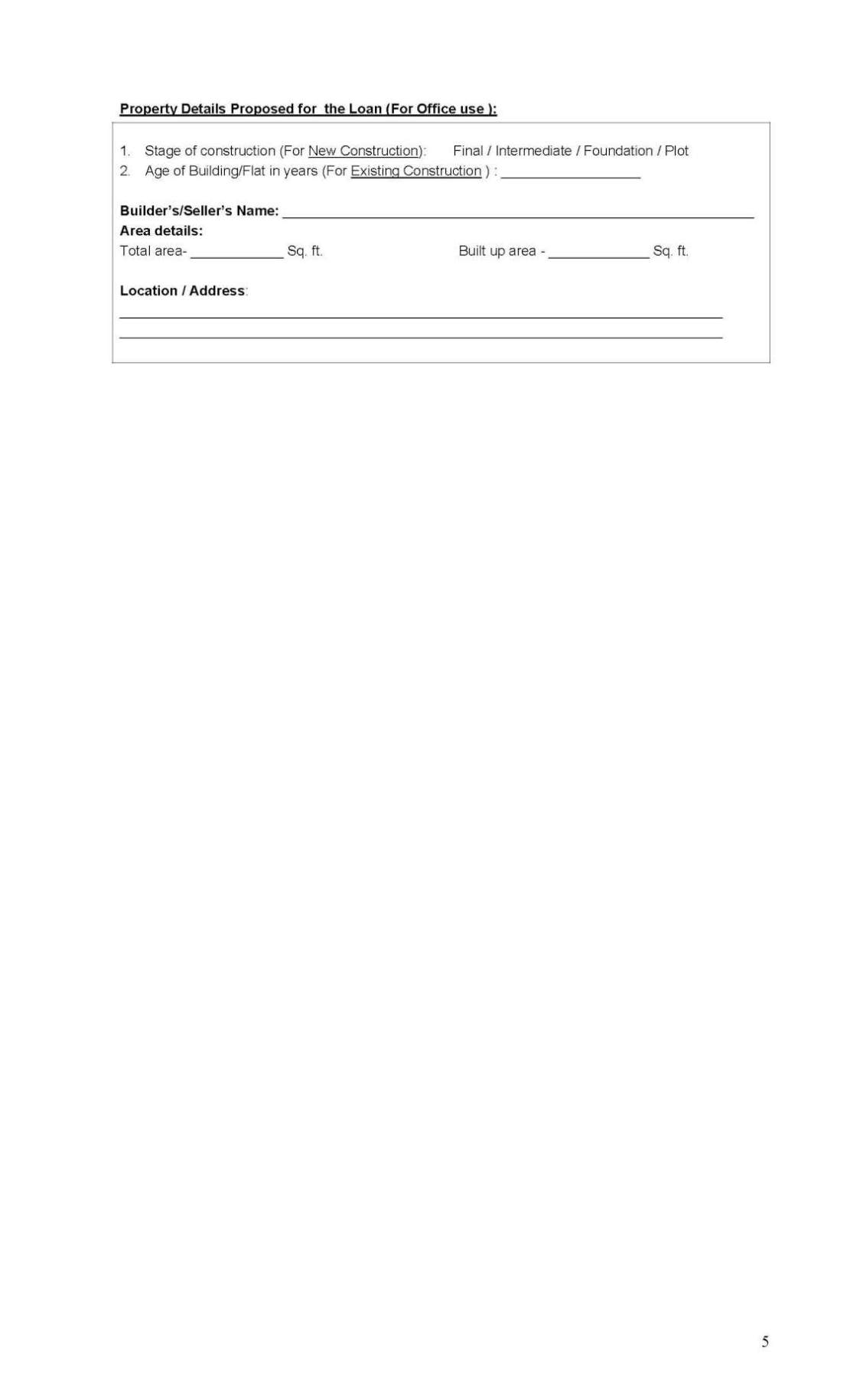

Bank finance Home Loan for purchase of house / flat, construction / repair / renovation of house, purchase of plot and construction of house thereon. Applicant needs to submit duly filled in Application Form along with other related documents as per requirement of the Bank. Bank assess the application based on Bank's / RBI's guidelines and takes decision.

Comments

Post a Comment